Welcome to the collapse of the Synconomy (trademark pending).

What is the synconomy you say. Well by my well trained, unpaid marketers (me), it’s short for Synthetic Economy. A fragile construct propped up by debt, stimulus, and monetary tricks. It works only as long as confidence holds. It projects a strong unbreakable economic foundation, but cracks can be heard rippling through the hull. While the crew (politicians) keep us distracted with who’s offending who..

What’s fueling the collapse? Well there’s a few things really, some would say a perfect storm.

- Cascading debt

- Increased spending

- Unemployment

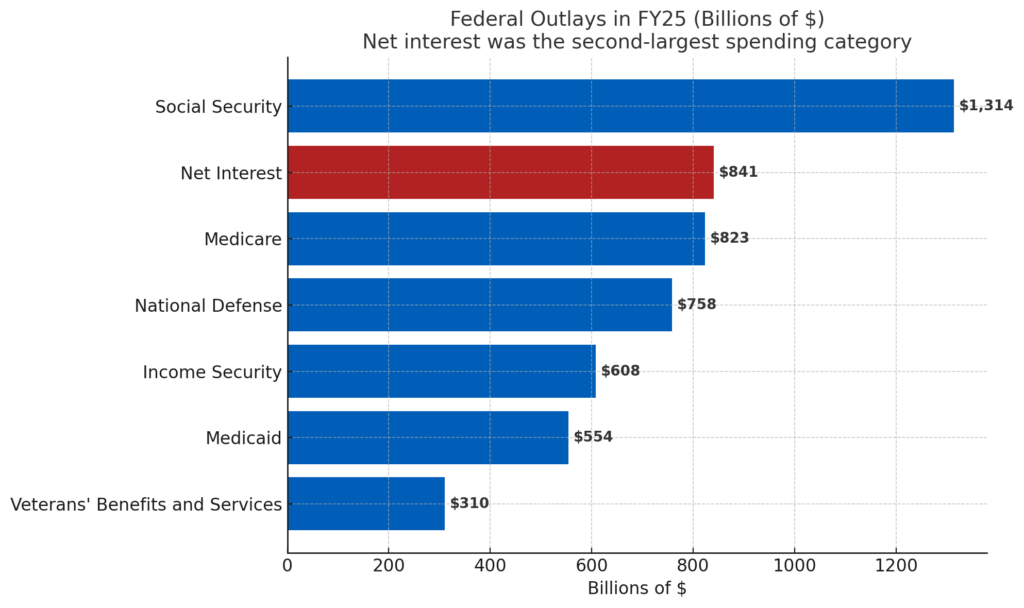

The national debt has passed $37 trillion, and annual interest payments ($841B)alone are consuming more than what we spend on defense ($753B). Inflation, while somewhat cooled from its peak, still lurks in the background. Yet with employment numbers flashing red, the Federal Reserve is pretty much in a position where they have to cut the rate to “save the economy”. That decision, once taken, sets us on a collision course with fiscal dominance. A fascinating world where debt dictates monetary policy, not inflation control. Note – I’m replacing terrible with fascinating in this article, it’s fun.

Meanwhile, our country continues to accrue a ton of debt.

What the <insert expletive here> is Fiscal Dominance?

Fiscal dominance occurs when government debt and deficits grow so large that they leave central banks with no real independence. Instead of setting rates to control inflation, the Fed is forced to accommodate the cost of government borrowing. In plain terms, the national debt becomes the boss. Raising rates may still be the ‘textbook’ response to inflation, but when it risks adding trillions in additional interest payments, the Fed has no choice but to cut, or at least hold rates low, no matter what inflation is doing.

So what does that mean, well that means regardless of out of control inflation the fed will be powerless to do anything about it. The monetary policy will remain permanently loose, which risks devaluing the US currency further, fueling more inflation. Spiraling up and up and up. Soon we’ll all be millionaires, and all be broken.

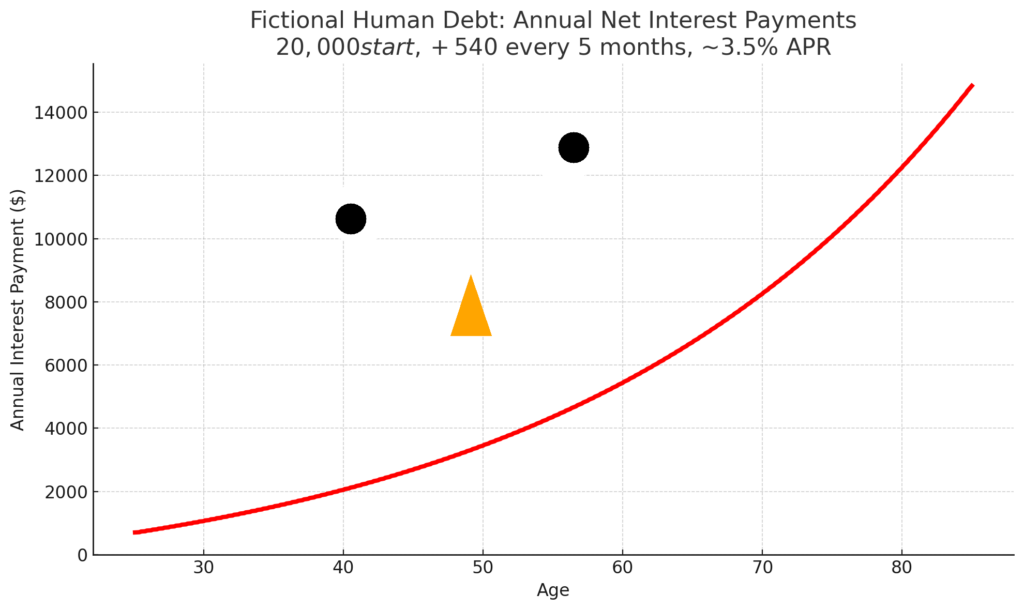

I mean, look at the chart up there. Interest is the second biggest bill our nation has and we’re adding approximately 1 trillion to that every 5 friggin months. I mean that’s insane. I mean if you had 20K in debt and you’re adding 540 every 5 friggin months. Do you think you could sustain that forever? And remember that $540 compounds onto the interst payment. Here’s what that looks like every 10 years assuming you’re 25 now an you live to 85.

You’re reading that, correctly. By 85, you’d be paying over $14,837.02 in net interest. Interest is a hell of a drug – RIP Rick James. I added eyes and a nose to make the graph smile or look sarcastically at you. Dealers choice. And if this sounds insane for one person, imagine it scaled to a $37 trillion government balance sheet.

Cascading Debt

Washington loves to spend money, they really do. And the commitments keep piling up. On top of our already staggering bills, there are new external pressures adding more debt to our books.

- Farmers are asking for aid to offset high costs and low margins.

- Massive detention and security projects—like the so-called ‘Alligator Alcatraz’—are being funded.

- ICE is ramping up hiring with $50,000 bonuses.

- The military is being deployed within U.S. states and in Washington, D.C., with all the associated costs of logistics and readiness.

- Trade deals, currently unsigned, with Japan and the UK include mostly loan guarantees to the US.

Each of these may be defensible in isolation, but together they represent billions more in spending. And all of it is financed through more borrowing, adding to an already unsustainable trajectory. This is not an article of ethics, this is a dollars and cents conversation. All these things will minimally add billions of dollars to our debt.

Employment Numbers Are No Bueno

The latest jobs report shows the economy has stalled. Job growth has been weak for three months in a row, with declines in full-time work and a worrying rise in part-time employment. Unemployment has ticked higher, and participation rates remain below pre-pandemic levels. For the Fed, this labor weakness trumps inflation concerns. Employment is the political pressure point—meaning the Fed will be compelled to ease policy to avoid further pain in the job market.

So lets say we cut rate by say 300bps over the next year, however we continue to spend at our current rate. Well that leaves us in a position that raising the rates again would increase our interest exposure that we would literally have to rob Peter to pay Paul In other words, we’d have to cut somewhere else to fulfil our payment obligations, or substantially raise taxes.

The Trap of Fiscal Dominance

Put all of this together and the trap becomes clear:

- The Fed must cut rates to support employment.

- Rate cuts and fiscal spending expand the money supply.

- Inflation re-ignites, but the Fed cannot raise rates again without bankrupting the Treasury.

That is fiscal dominance. It’s something that many Americans are familiar with at their level, but America has been pretending it doesn’t see coming.

Final Eulogy

November 7, 2024 , the day of the last Federal Reserve rate increase. It will be remembered not as the final stand of monetary independence. That moment marked the turning point when policy yielded to debt, and the balance sheet became the master. From that day on, the course was set, the government’s burden would dictate the Fed’s hand. And once that line was crossed, there was no return.

Uncle Sam has been on a hell of a ride, but we all knew that the fun would end eventually. And in typical fashion, he went out with a bang. The sound of the last bullet leaving the chamber and into the heart of fiscal independence itself. A future we may not be able to reclaim.

Go Fish

National Debt ($37T)

Net Interest Payments ($841B)

Defense Spending ($753B)

- Same Peterson Foundation chart or Congressional Budget Office (CBO) – Budget Data

Jobs Reports / Employment Data

M2 Money Supply Chart

- Link: FRED – M2 Money Stock

Fed Rate Hikes Timeline